52+ how much of your income should be spent on mortgage

If your anticipated homeownership. Web According to this rule your mortgage payment shouldnt be more than 28 of your monthly pre-tax income and 36 of your total debt.

What Percentage Of Your Income To Spend On A Mortgage

Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web To use this calculation to figure out how much you can afford to spend multiply your gross monthly income by 028. Ad See how much house you can afford.

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just. However how much you. Try our mortgage calculator.

Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income.

Get an idea of your estimated payments or loan possibilities. That might sound exciting at first but with a. And you should make.

Ad Realize Your Dream of Having Your Own Home. For example if your gross monthly. Ad Understanding Reverse Mortgage And Its Calculation.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Apply for Your Mortgage Now. Web As a general rule your total homeownership expenses shouldnt take up more than 33 of your total monthly budget.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Compare Rates of Interest Down Payment Needed in Seconds.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Get an idea of your estimated payments or loan possibilities. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Looking For Reverse Mortgage Calculator. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

Try our mortgage calculator. Estimate your monthly mortgage payment. This is also known as the.

Ad See what your estimated monthly payment would be with the VA Loan. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. View Ratings of the Best Mortgage Lenders.

Web Based on your DTI and depending on your other debts you could be approved for a mortgage of 600000.

Mortgage Loan Wikipedia

Project Round The World Trip In 365 Days Lawkwatsera

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Your Income To Spend On A Mortgage

15 Possible Reasons Why You Are Still Poor Project House

52 Photography Marketing Ideas For Your Photography Business Magazine Mama

0 Dragoo Road Maryland Ny 12155 Mls 134670 Howard Hanna

Income To Mortgage Ratio What Should Yours Be Moneyunder30

How Much House Can I Afford Moneyunder30

What American Expats About Us Expat Tax In Spain Americans Overseas

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Comprehensive Wow Classic Gold Guide Warcraft Tavern

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

Work From Home Jobs Australia 52 Jobs You Can Do From Home Work With Joshua

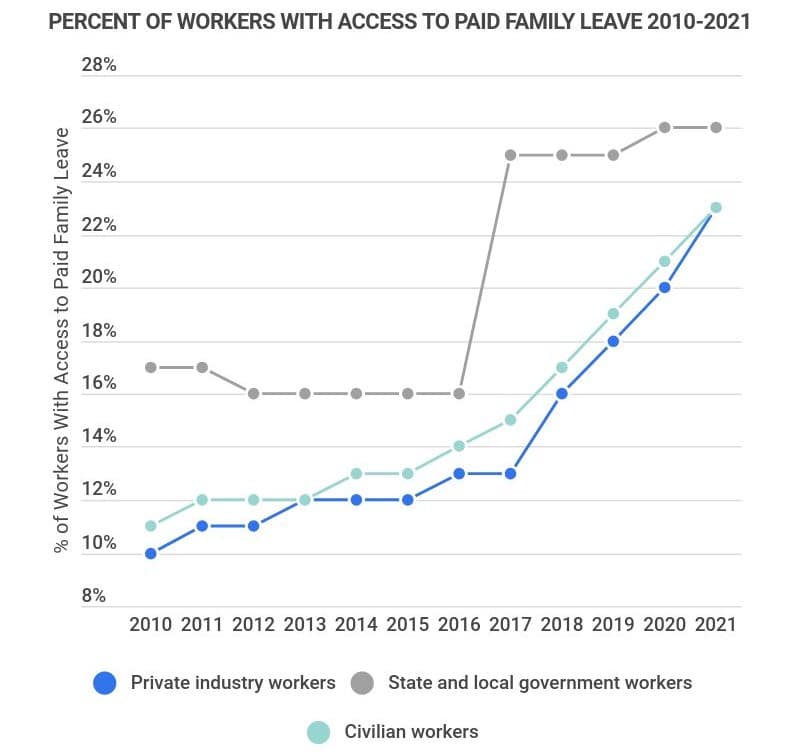

Average Paid Maternity Leave In The Us 2023 Us Maternity Leave Statistics Zippia

Chart Of The Day Focus On The Easy Money Smart Money Tracker